Most people today really feel a little annoyed if a inventory they very own goes down in price tag. But often it is not a reflection of the essential enterprise efficiency. The Easterly Government Attributes, Inc. (NYSE:DEA) is down 11% more than a 12 months, but the overall shareholder return is -6.4% at the time you include things like the dividend. That is greater than the current market which declined 16% over the final 12 months. The silver lining (for for a longer period time period investors) is that the stock is however 5.1% larger than it was a few a long time in the past.

With that in mind, it truly is well worth viewing if the firm’s underlying fundamentals have been the driver of very long term performance, or if there are some discrepancies.

See our hottest analysis for Easterly Authorities Homes

There is no denying that markets are occasionally efficient, but prices do not constantly replicate fundamental small business effectiveness. 1 flawed but reasonable way to evaluate how sentiment close to a company has improved is to examine the earnings for each share (EPS) with the share selling price.

Even while the Easterly Government Properties share rate is down more than the 12 months, its EPS essentially improved. It’s really possible that advancement anticipations might have been unreasonable in the earlier.

It is really truthful to say that the share value does not seem to be to be reflecting the EPS progress. So it really is effectively worthy of examining out some other metrics, much too.

Easterly Governing administration Properties’ dividend looks healthful to us, so we question that the yield is a concern for the marketplace. The income trend doesn’t appear to describe why the share selling price is down. Except, of system, the industry was anticipating a profits uptick.

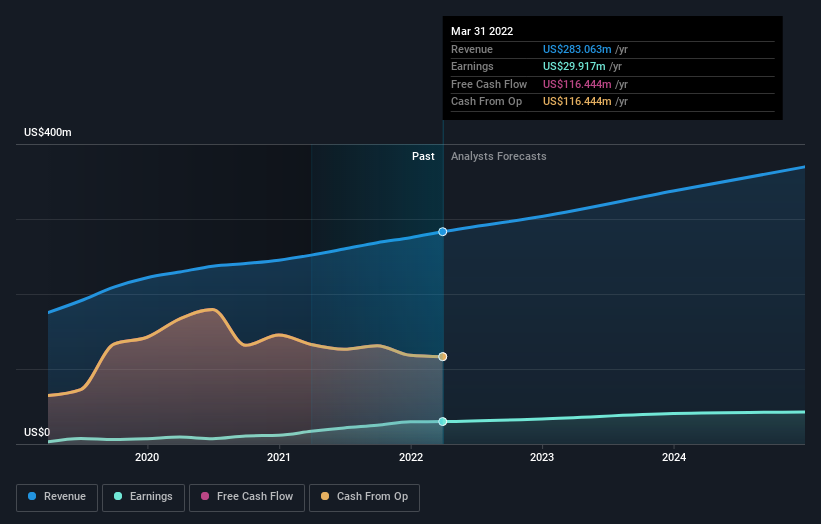

The graphic down below depicts how earnings and earnings have adjusted more than time (unveil the correct values by clicking on the impression).

It is of program excellent to see how Easterly Govt Attributes has grown income over the a long time, but the potential is a lot more significant for shareholders. If you are pondering of shopping for or selling Easterly Government Properties stock, you must verify out this Free of charge comprehensive report on its equilibrium sheet.

What About Dividends?

When seeking at expenditure returns, it is essential to consider the distinction among complete shareholder return (TSR) and share rate return. While the share rate return only displays the transform in the share rate, the TSR contains the value of dividends (assuming they have been reinvested) and the benefit of any discounted cash increasing or spin-off. It is really reasonable to say that the TSR presents a additional full image for shares that pay a dividend. In the case of Easterly Governing administration Properties, it has a TSR of -6.4% for the very last 1 calendar year. That exceeds its share rate return that we formerly mentioned. And there is no prize for guessing that the dividend payments largely describe the divergence!

A Diverse Point of view

Though it hurts that Easterly Governing administration Qualities returned a reduction of 6.4% in the very last twelve months, the broader marketplace was really worse, returning a reduction of 16%. For a longer time phrase traders would not be so upset, given that they would have manufactured 4%, every single 12 months, around five years. It could be that the enterprise is just dealing with some brief time period challenges, but shareholders really should retain a shut eye on the fundamentals. I uncover it very attention-grabbing to look at share cost above the extensive expression as a proxy for enterprise functionality. But to truly attain insight, we require to think about other info, much too. To that close, you should master about the 3 warning indications we’ve spotted with Easterly Federal government Qualities (like 1 which is a bit about) .

Of class, you may well discover a wonderful investment decision by hunting elsewhere. So acquire a peek at this cost-free record of businesses we be expecting will mature earnings.

Please observe, the marketplace returns quoted in this post reflect the sector weighted typical returns of stocks that currently trade on US exchanges.

Have comments on this posting? Concerned about the information? Get in touch with us right. Alternatively, electronic mail editorial-group (at) simplywallst.com.

This article by Only Wall St is general in nature. We provide commentary based mostly on historical information and analyst forecasts only applying an impartial methodology and our articles are not supposed to be economic information. It does not represent a recommendation to invest in or promote any inventory, and does not choose account of your aims, or your economic problem. We purpose to bring you lengthy-expression centered evaluation driven by essential info. Note that our evaluation may perhaps not variable in the newest selling price-delicate firm announcements or qualitative materials. Simply just Wall St has no place in any shares outlined.

Be a part of A Paid out User Exploration Session

You will acquire a US$30 Amazon Present card for 1 hour of your time when supporting us develop improved investing resources for the person investors like on your own. Indicator up here