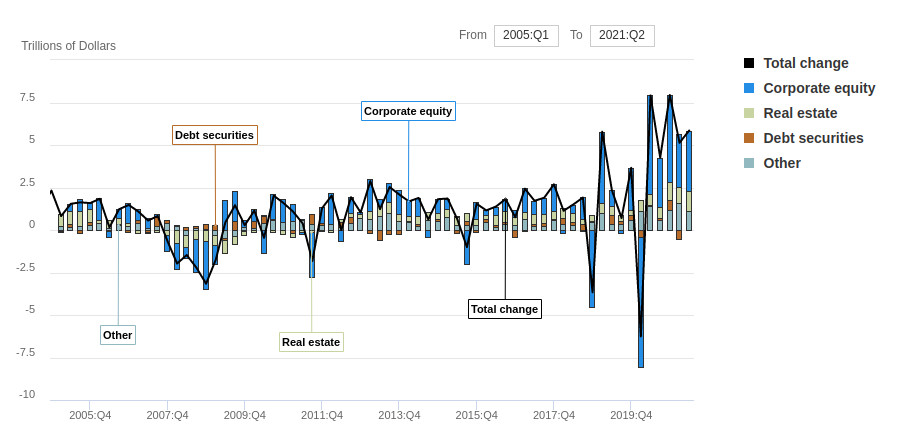

Americans have never been richer. The Federal Reserve

recently published its 2Q 2021 report looking at the health of the economy. Total household net worth is $159 trillion, up $32 trillion (+25%)

since the depth of the pandemic fears in 1Q 2020.

Of the $32 trillion increase in household net worth, $20 trillion (64% of the total increase) is from a booming stock market and related investments,

while $5 trillion (14% of the total increase) is from higher home prices. Who would have thought that the market would be so hot one year

following the greatest job loss in history during 2020?

Low interest rates and fiscal stimulus have helped juice the economy. Demand is high, which is leading to

shortages in various supply chains, such as new heavy-duty trucks.

Housing demand is high as employment grows and wages gain. Supply chain constraints extend to the housing industry, which in

turn is causing higher

new home construction costs.

US Household Net Worth

Source: Federal Reserve

Takeaway: The household net worth gains over the past year are large compared to history.

EyeOnHousing

noted that real estate assets are increasing much faster than real estate liabilities. Homeowners’ equity increased in the latest quarter

to $24 trillion, or 68% of all household real estate. This represents the highest share since 1989.

NAHBNow recently reported

builder confidence rose in September after a three-month decline as lumber prices moderated and housing prices continued to increase.

Builder confidence had eroded recently as home builders were faced with worsening building material supply chain issues

and labor challenges.

Builder sentiment has been gradually cooling since the HMI hit an all-time high reading of 90 last November.

The September data show stability as some building material cost challenges ease, particularly for

softwood lumber. However, delivery times remain extended and the chronic construction labor shortage is

expected to persist as the overall labor market recovers. – NAHB Chairman Chuck Fowke

The NAHB/Wells Fargo Housing Market Index (HMI) rose one point to 82 in September 2021. The HMI measures

builder perceptions of current single-family home

sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks

builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.”

Scores for each component are then used to calculate a seasonally adjusted index where any number over

50 indicates that more builders view conditions as good than poor.

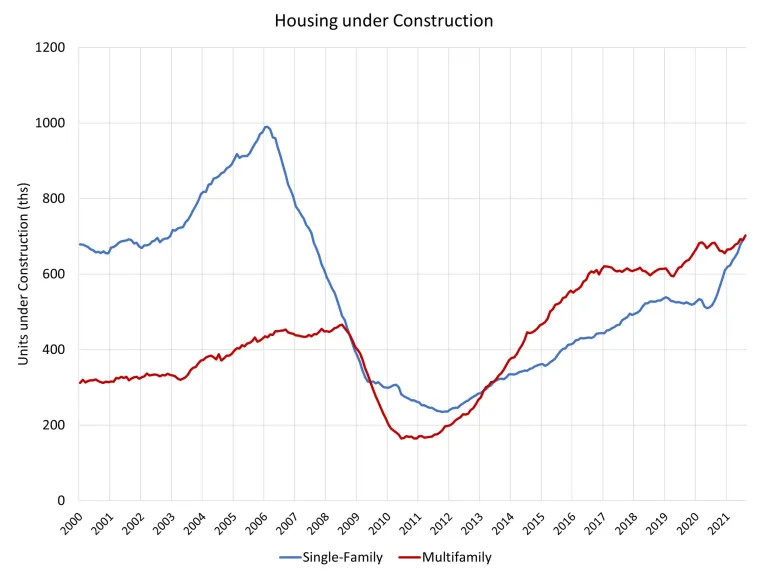

New Single-Family Home Construction Is Increasing

The inventory of homes available for sale is much lower than it should be. According to

Altos Research,

the inventory of homes available for sale is about 50% lower than what Altos considers a “normal” level.

Altos’ August update showed that inventory availability is improving slightly, but there remains a long road

ahead to get back to normal levels.

Source: Altos Research

Takeaway: Inventory of homes available for sale began to rise recently after a multi-year downtrend.

Nationwide inventory of homes available for sale remains about 50% of a “normal” level, which supports an

extended construction recovery.

The need for more housing should continue to benefit new and used construction equipment sales, as well as equipment

rental. Residential construction has knock-on effects, whereby cities need to build more infrastructure such as

roads, utilities, schools, hospitals, etc. Non-residential construction is influenced by residential construction, and it

historically has followed residential construction trends by a 6-12 month lag.

Construction equipment manufacturers and

equipment rental companies are positive on the residential construction outlook as well.

Caterpillar, John Deere, Case Construction, United Rentals, Sunbelt Rentals, Herc Rentals and others cited positive trends and

an optimistic outlook.

Source: EyeOnHousing

Takeaway: New single-family homes under construction accelerated in 2021 as prices rose.

Single-family new home construction was at an abnormally low level following the financial crisis.

The industry under-built new homes relative to long-term trends for about a decade (see blue line above), which is why

we are facing the current housing availability shortage.

Overall, the outlook for both residential and non-residential construction is optimistic at the moment.

As long as interest rates stay in check, there is a strong need to build more homes and get back to

a normal housing inventory level.

Find Similar Articles By Topic

#construction

#real estate

#housing