Productive gross money is a line item on a real estate proforma that is usually made use of by appraisers, traders, and other professional genuine estate pros. While the successful gross cash flow is uncomplicated to recognize conceptually, the calculation by itself can occasionally be perplexing. In this posting we’ll acquire a closer seem at efficient gross earnings and distinct up any confusion.

Effective Gross Cash flow Formulation

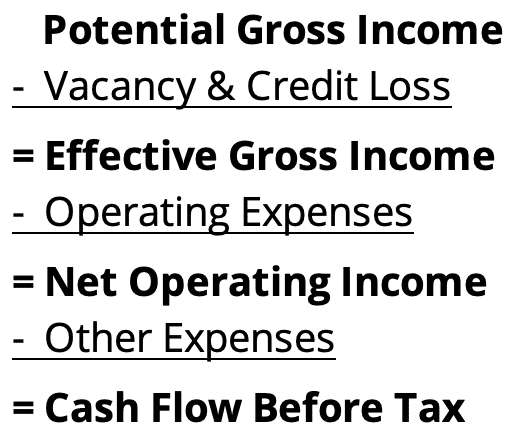

The Powerful Gross Earnings (EGI) system is described as the Prospective Gross Profits for a property minus any emptiness and credit score reduction.

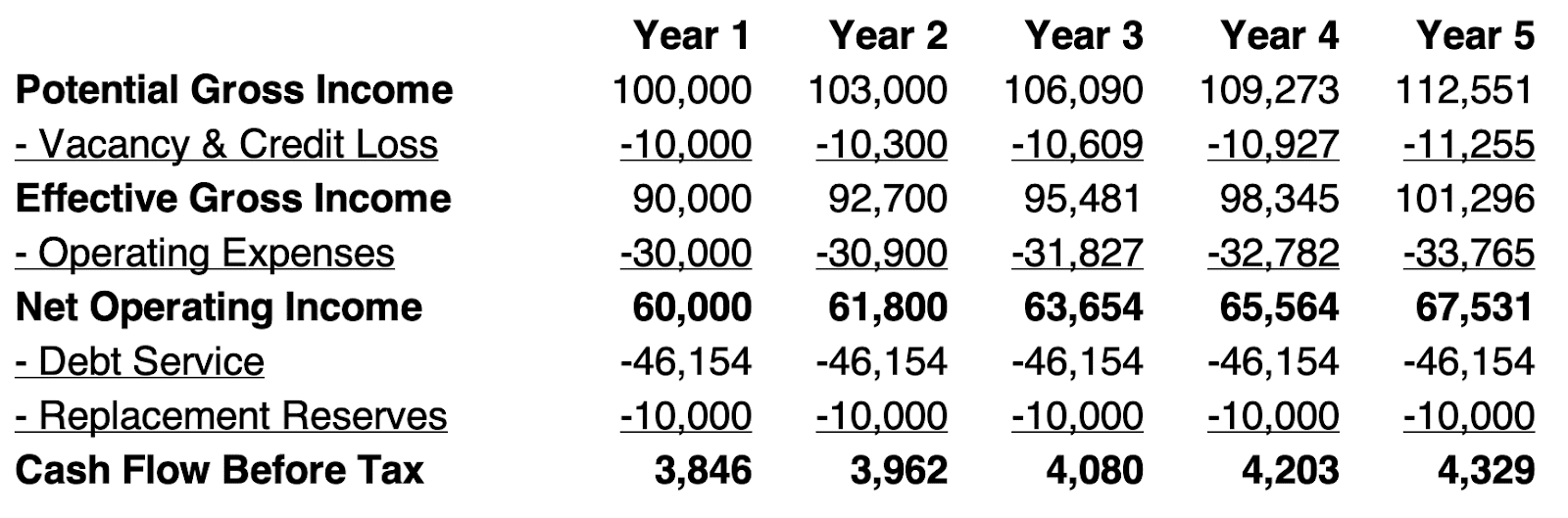

As you can see in the productive gross money formulation higher than, the successful gross revenue is an intermediate phase when calculating the net running income and the bottom line hard cash move in advance of tax for a property.

Even though the successful gross cash flow calculation can be as basic as the above formula shows, in follow there is typically additional nuance. Given that distinct professional houses will have unique sources of earnings, lease structures, reimbursements, etcetera. that usually means the productive gross cash flow calculation can differ relying on the residence type and situations.

How to Work out Productive Gross Revenue

Let us to start with think about a uncomplicated case in point and then we’ll seem at a much more sophisticated efficient gross profits calculation.

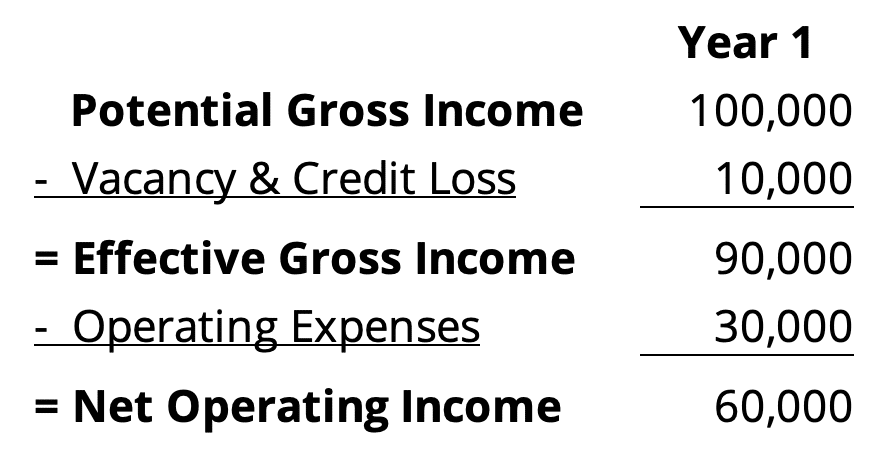

A easy back of the envelope proforma for a one tenant assets may possibly appear like this:

In this case in point the emptiness & credit history loss is all revealed on a single line. In uncomplicated proformas like this the vacancy line product is often calculated utilizing a proportion price, which is 10% in this scenario.

The helpful gross earnings previously mentioned is calculated by using the possible gross income for the assets and subtracting the 10% emptiness and credit score reduction used. In this instance the efficient gross earnings is 100,000 – 10,000, or 90,000.

For a multi-period of time proforma this calculation is effective the exact way and is repeated for each and every interval in the analysis:

Detailed Powerful Gross Money Calculation

Considering the fact that various assets styles will have distinct situation and qualities, proforma formats can and do change in apply. This usually means the successful gross profits calculation by itself can change as perfectly.

Look at a multi-tenant business developing that is fifty percent vacant at acquisition with a number of leases expiring for the duration of the keeping time period. For a more challenging proforma like this, an absorption and turnover emptiness line merchandise is generally modeled on the proforma. This line merchandise calculates the actual vacancy in the holding period prior to a lease start out day (absorption), and the actual emptiness right after a lease expires and in advance of the subsequent lease commences (turnover emptiness). This true vacancy calculation is driven by the tenant’s contractual lease begin and end dates alternatively than an over-all percentage vacancy amount like we used in the very simple illustration higher than. Ordinarily these current market leasing terms are modeled on a proforma working with marketplace leasing profiles.

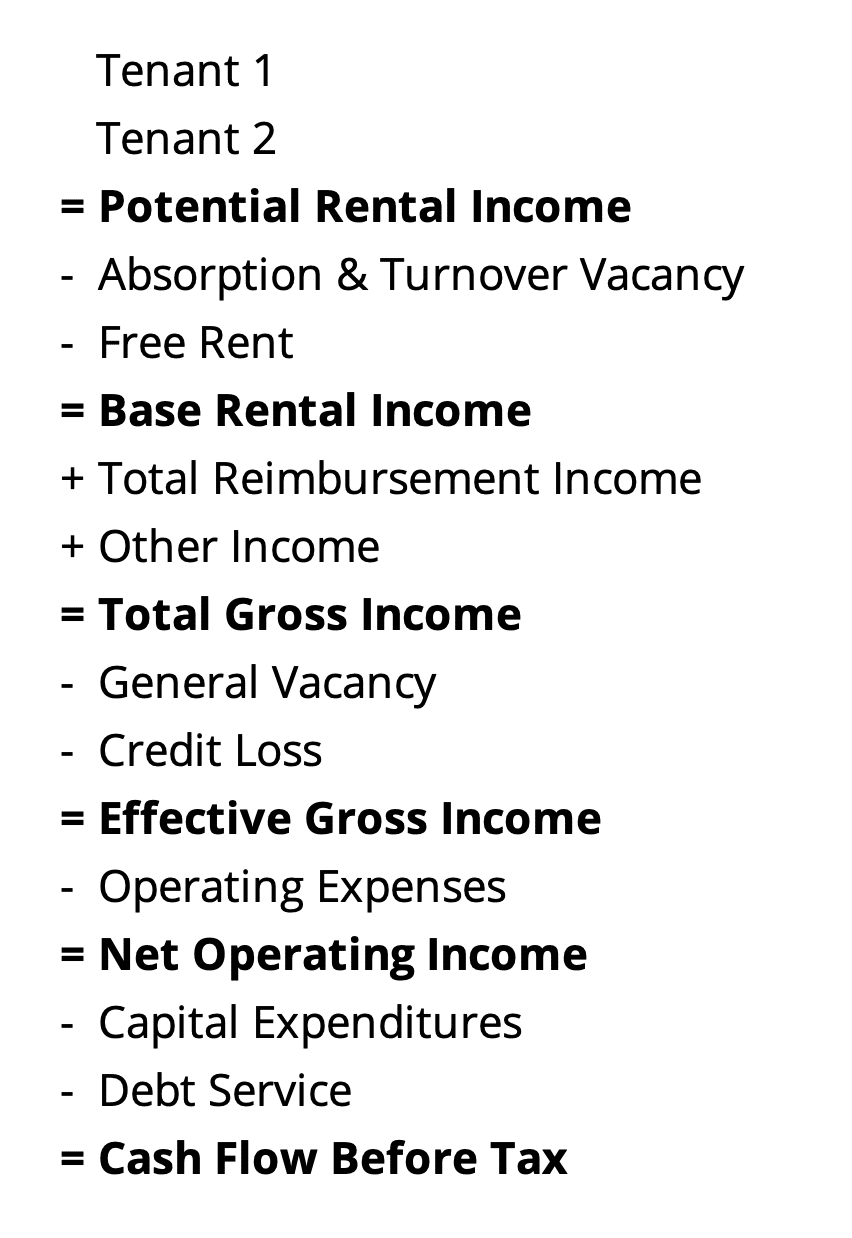

The line objects on a extra sophisticated proforma could glimpse like this:

To estimate the powerful gross cash flow we commence with the prospective rental income for the residence, which is the base lease a property would receive if it were being 100% occupied. For intervals of time when a room is vacant, an estimated market place based mostly hire is used to estimate the possible rental income.

Up coming, we deduct absorption and turnover emptiness. The absorption is equal to the current market rent used to work out potential rental profits prior to a lease start out day. Similarly, the turnover vacancy is equal to the sector rent applied to calculate prospective rental earnings following a lease expires prior to the upcoming tenant beginning occupancy. In other text, this absorption and turnover vacancy line merchandise entirely offsets any current market lease proven during vacant durations in the likely rental revenue line.

Just after subtracting any free hire specified to tenants as an incentive to indicator a new lease, we get to the foundation rental cash flow line merchandise. The foundation rental profits is the genuine base rent a landlord is anticipated to collect from tenants.

We then insert in any reimbursement earnings from tenants. Reimbursement profits calculations can fluctuate from very simple to elaborate based on the lease construction for each tenant. For example, a tenant could have a easy triple internet lease with an obligation to pay back its pro-rata share of all bills. On the other close of the spectrum is a gross or whole assistance lease that involves the landlord to spend all operating costs. In this case there would be no tenant reimbursement. Nevertheless, a modified gross lease is most popular, the place each the landlord and the tenant every single have some responsibility for shelling out running fees.

Subsequent, we include in any other profits for the residence which could contain parking fees, vending earnings, etc. This gets us to the whole gross revenue line merchandise, which is the overall income a assets is expected to crank out from tenants as effectively as other money resources.

We then have a deduction for normal emptiness. This is a calculation above and over and above the true vacancies calculated on the absorption and turnover emptiness line product. Generally this line merchandise is omitted when employing absorption and turnover vacancy calculations. However, in some cases a market emptiness aspect is still employed in the common vacancy line to make certain the total vacancy in a proforma is at least as substantial as the market. For example, if the absorption and turnover emptiness amounts to 5% but the market place vacancy charge is 10%, then an excess 5% of emptiness could be proven in the standard emptiness line item. It is popular for appraisers and loan providers to do this when estimating the market place value for a assets.

A credit history decline estimate can also be demonstrated, which is a deduction for tenants who do not pay out their rent. This is generally estimated as a percentage of total gross cash flow.

Lastly, after deducting normal vacancy and credit decline from the whole gross income line merchandise, we have calculated the powerful gross money.

Powerful Gross Revenue Multiplier

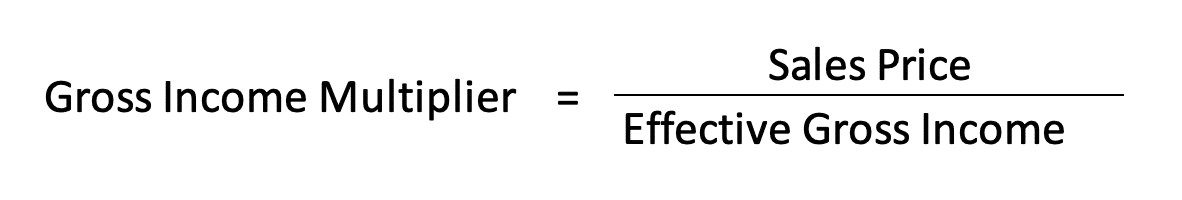

The effective gross earnings can be applied to calculate the gross revenue multiplier. The gross cash flow multiplier is the ratio of a property’s sale price or worth to its gross earnings.

The helpful gross profits multiplier uses the effective gross profits line item on a proforma as the numerator in the efficient gross revenue components.

For illustration, suppose the income price of a home was 1,000,000 and it had an successful gross revenue of 200,000. In this case the efficient gross income multiplier would be 1,000,000 / 200,000, or 5.00.

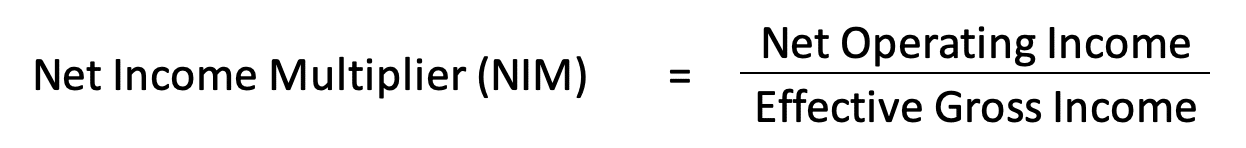

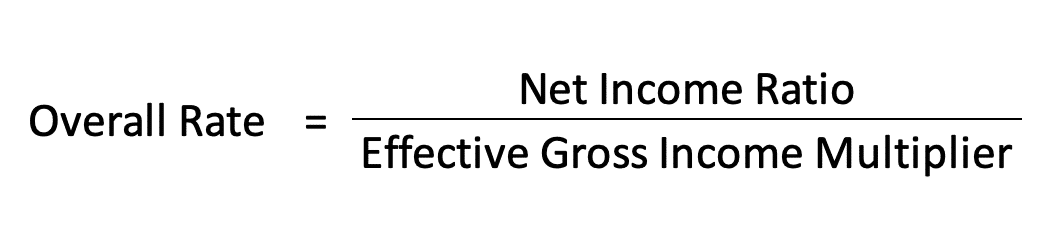

Appraisers in some cases use the successful gross earnings multiplier alongside with the internet income ratio to estimate the total capitalization charge. The web earnings ratio is calculated by having the web working cash flow for a assets and dividing it by the property’s effective gross profits:

This procedure is used when demanding information prerequisites can’t be achieved on similar gross sales. If gross cash flow is offered for equivalent revenue then the total cap fee can still be believed by employing a marketplace average expense ratio which is a lot easier for appraisers to acquire.

For instance, suppose the current market common expense ratio was regarded to be 55% for a unique house style in a particular industry. A similar home is identified but you are only able to acquire info on possible gross money and successful gross money. In this case, the comparable residence marketed for 400,000 and had an powerful gross revenue of 80,000. Using this information and facts together with the industry typical expense ratio, we can estimate the in general capitalization charge.

If we apply the 55% operating price ratio to the 80,000 efficient gross money, then we get an estimated internet working earnings of 36,000. The productive gross profits multiplier is 400,000 / 80,000, or 5.00. The web revenue ratio is 36,000 / 80,000, or .45. Now we can derive the in general capitalization rate from the similar property as follows:

So, in our illustration, the in general charge would be .45 / 5.00, or 9.%. This course of action could be repeated for every single equivalent sale discovered. Then an in general capitalization charge could be believed by reconciling each cap charge derived from the comparables.

Summary

In this report we described effective gross cash flow, confirmed you how the helpful gross cash flow formulation functions, and then walked by in depth illustrations of how to compute the efficient gross profits. We applied two instance calculations. First we confirmed you a uncomplicated powerful gross cash flow calculation that only considers a general vacancy and credit reduction aspect.

Future, we walked by a far more advanced illustration that included absorption and turnover emptiness, no cost hire, reimbursement cash flow, and also other miscellaneous money. Finally, we discussed a simple way to use the helpful gross income by calculating the gross earnings multiplier. The gross money multiplier is often applied by appraisers to estimate the overall capitalization level when comprehensive equivalent gross sales data are unable to be attained.