This fall has been a mixed bag, to say the least.

We’ve had listings that have received multiple offers and we’ve had listings that have sat on the market.

We’ve had buyers successfully purchase homes amid competition in multiple offers and we’ve had buyers purchase properties with upwards of ten sign-backs on the price and terms.

As much as I want to say, “There’s no rhyme or reason to the market out there,” there is, if you pay attention.

Sure, there’s always that handful of sales that raise eyebrows, but for the most part, you can see a failed offer night and a re-list a mile away.

Then there are the listings that come onto the market and you wonder, “What’s the point? Why is the seller even bothering?”

So today, let’s explore a few listing “strategies” and question what the hell the sellers and/or agent were thinking, or give kudos when it worked out.

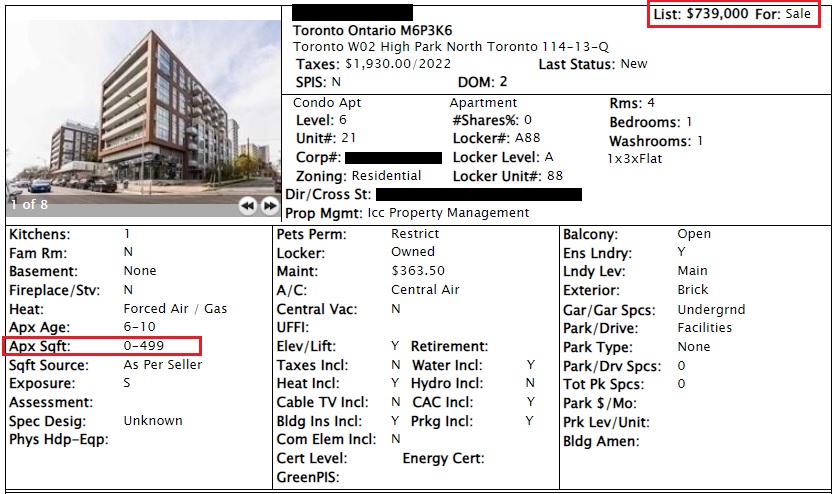

Here’s a listing I saw the other day for which I immediately did a double-take:

Note the price and the square footage.

This unit is 466 square feet and it’s priced at $1,586/sqft.

It seems a bit rich, but when you look at the listing history, it makes even less sense.

Note what they paid, when they bought, and what they’ve done since:

Alright, so they bought the condo in October of 2021 for $620,000.

They leased it out for $1,900/month.

One year later, they leased it out for $2,275/month.

But then five days after that, they turned around and listed it for sale?

Selling tenanted units are very, very tough in this market! And yet it seems like these guys went out of their way to get the unit tenanted so they could then turn around and list.

If that was a “strategy,” it’s the complete opposite of what the strategy should have been. In this market, you always try to list when the tenant is gone, or even incentivize the tenant to leave so you can list the unit vacant and staged.

But what do we make of that price?

Has the market really gone up 19.2% since they bought?

Comparing average price from October of 2021 through October of 2022, the average GTA home price is down 5.7%, the average 416 home price is down 2.6%, and the average 416 Condo price is up 0.1%.

So if we want to cherrypick data here, we’d use the last price.

Only, 0.1% is still slightly less than 19.2%….

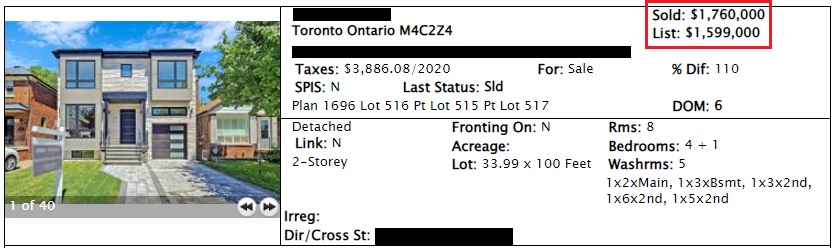

Here’s a beautiful house that sold in June of 2021:

Now, let’s say that “life happens” and you want to sell this in October of 2022.

What do you do?

First, you try listing at $1,895,000 with an “offer night” and seeing what happens.

If that doesn’t work, then you raise the price, let’s say, to $2,050,000.

Then what?

Now you’re priced 16.5% higher than what you paid in June of 2021.

How has the market moved since then?

On average, the GTA home price is flat – literally differing by $108. The average 416 home price is up 1.2%. And the average 416 detached price is down by 5.3%.

So was that $2,050,000 list price going to work?

No.

They re-listed at $1,799,999, again with an “offer night.”

And amazingly, that worked!

They sold for $1,850,000:

While the seller might feel snakebitten here, this is actually a very good turn of events.

The listing agent put a strategy together and followed it, and the property sold for a good price.

Two weeks ago, a client of mine reached out and said he wanted to see a house that had been sitting on the market.

I took one look at the listing and I said, “You’re kidding, right?”

This house was listed for $2,880,000.

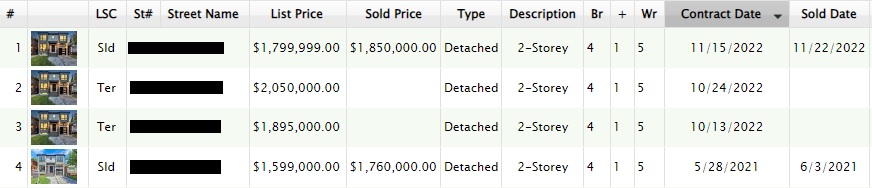

But the listing history showed the following:

This property had been on the market for almost 3 1/3 months.

They started at $3,850,000 and eventually came down to $3,580,000.

But now they were at $2,880,000 with an offer date?

You know how I feel about trying Plan-A after Plan-B, but this time around, it seemed even more foolish.

If they were gunning for, say, $3,000,000 even, then the $2,880,000 list price might bring a fresh subset of buyers into the property who could maybe be convinced to pay up.

But what did they really want here?

My clients saw the house and said, “This feels like it’s a $2.8 Million house.”

Give or take, but either way, this was a “wait and see” listing, as so many of them are today.

The listing agent called me on the offer night, all amped and excited, asking, “Are you bringing an offer?”

The question was odd, but I don’t think the listing agent knew that.

She immediately added, “Any feedback?”

I asked her if she wanted some honest feedback and she said that she did.

So I told her, “You’re on your fourth listing now, at your third price, and for some reason you’re listing an over-priced property with an offer date. Nobody’s getting involved with this, are they?”

She said, “Well, we do have one offer.”

I told her: “Take it. Whatever it is, provided it’s at your list price, take it.”

That was the end of our call.

So did she listen?

Nope!

They raised the price by $700,000 the next day!

What were they thinking?

Did they think that nine buyers were going to submit offers on this house, get carried away, and bid it up seven hundred thousand dollars over asking?

There’s no strategy here. Just a combination of greed, stupidity, and a wilful ignorance.

Back in early October, I took clients to see an east-side listing that was up for $2,188,800.

It felt like a fair price if I’m being honest. Maybe a bit rich, as we were comparing to a property on the same street that was far superior, having sold for $2,450,000 in September, but working backwards from the sale price of a better property is very subjective.

We saw the house and it was alright. It checked most of the boxes, but it just didn’t feel special.

With the way the market was, is, you want a house to feel special if you’re ready to pull the trigger, specifically when you’re buying what you assume is a 20-year house.

I told my clients we should see if it’s still listed in three or four weeks and come back to it.

Four weeks later, I told my clients, “They’re still listed. Give some consideration to whether you’d be a buyer at, say, $2,000,000 even.”

Was that a realistic sale price?

Maybe. Should be. But maybe not.

The point was: if the buyers considered this house at a price that the seller wouldn’t take and they still wouldn’t pull the trigger, then 100%, it’s not the right house for them. This is a very good test for buyers who don’t actually know how motivated they are by price and how motivated they are by the perfect fit.

A few days later, the house was listed for $2,089,000.

The price reduction was right on cue.

Except, upon closer inspection, I realized that it was now listed for $2,089,000, with an offer date.

Oh, here we go again…

Look, if it were listed at $1,799,000 with an offer date, I still don’t like the “strategy” but I understand it.

But how in the world do you take a house that’s not selling at the $2,188,800 list price, then re-list at $2,089,000 with an offer date, and expect to find success.

The property didn’t sell on offer night. No kidding.

But none of this is crazy compared to the ending here, folks.

After the failed offer night, priced at $2,089,000, for the house previously listed at $2,188,000, they re-listed at………….$2,279,000.

So they raised the price.

Use the logic test here. When they were priced at $2,188,000, had somebody come along in the third week of that listing and offered, say, $2,170,000, they’d have jumped at it. So where’s the logic in now offering the house for sale for $2,279,000?

This isn’t a strategy.

It’s frustration and entitlement.

Another listing I’ve been watching tells a similar story to those above.

A house was listed for $2,399,000 in September, with an offer date.

It didn’t sell.

So now what?

Well, based on the stories above, after a house is “under-priced” and an offer date is set, and the offer date bears no fruit, the seller and agent typically re-list higher, somewhere around what they’re actually looking for, or what they were gunning for on the offer date.

We’ve seen this before, right?

Only this time, the property wasn’t re-listed higher. Something different happened. Something I don’t know that I’ve seen before, or at least not in recent memory.

What happened?

The property was re-listed even lower! This time for $2,149,000 with yet another offer date.

Back-to-back “underpricing with offer dates” as a strategy?

That really didn’t make any sense.

And it didn’t work either, as that listing was terminated.

So what do the sellers do now? Alter their expectations? Accept market reality? List at fair market value!

Nope!

Switch agents!

The property was listed with a new agent for $1,879,000, again, with an offer date.

But that didn’t work either.

Now, the property is listed for $2,399,000.

It seems to me, this property is probably “worth” between $2,100,000 and $2,200,000 in today’s market. Maybe it was worth more in July, and maybe it will be worth more in February, but right now, based on the other listings in the area that aren’t selling, this house is over-priced.

So what can we make of this?

Is there a “strategy” here on the part of the seller?

It doesn’t seem like it. Four listings, four prices, via two different listing agents, over the course of two months, and the house is unsold. It’s a tough market in this area, in this price point, but the seller doesn’t seem to have an actual strategy here. It looks like the seller is just jumping back-and-forth between bad ideas.

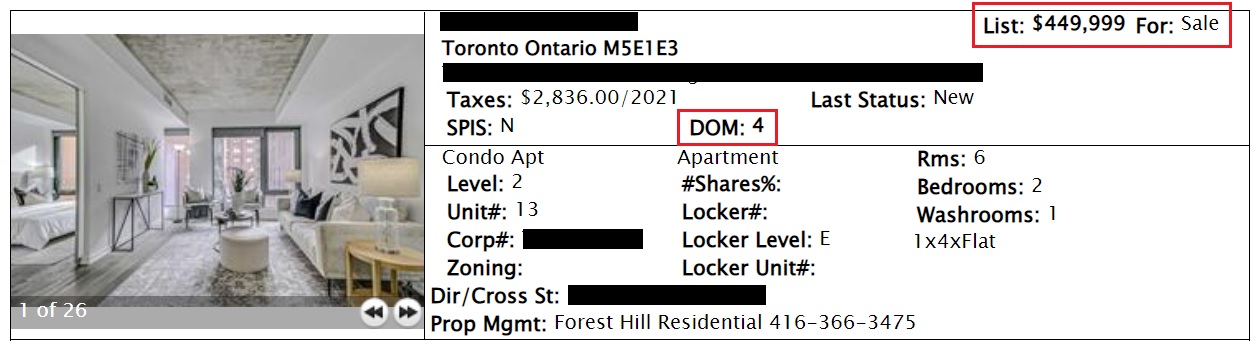

Here’s an interesting one!

Check out the listing:

So let me see here:

-$449,999, a price we never see

-2 bedrooms, and actually two bedrooms

-689 square feet

-heart of downtown

But there’s an offer date, right?

Nope!

Just a seller and agent fishing.

Just an $800,000 condo being listed at a stupid-low price, with no set offer date, and no intention of considering any offer within like 70% of that price.

I know that some of you in the past have said, “How is this different than what we see with every property that’s under listed?”

The difference is that when you detail on the listing, “Offers Reviewed December 3rd at 7:00pm,” you’re telling the market that you have a date for offers and thus the list price is merely a starting price; an arbitrary price.

In the case of the condo above, something is missing.

We’re long past “false advertising” in real estate, but I really do think there’s a big difference between under-listing with an offer date, and simply doing what the seller has done above.

There are a lot of different business models out there in the real estate industry, and recently there’s been a lot of buzz about a new discount brokerage that’s actually a re-named version of an older brokerage, which has been bought and sold many times over the years.

Every time I see listings from this brokerage, the properties are usually grossly over-priced.

It seems that people who don’t want to pay agents also don’t want to listen to agents, specifically around fair market value.

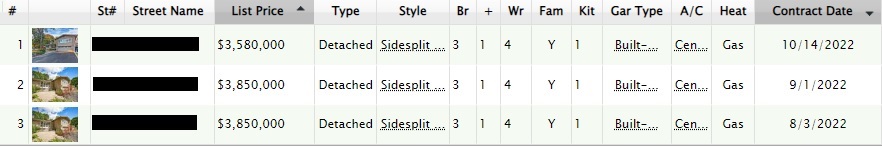

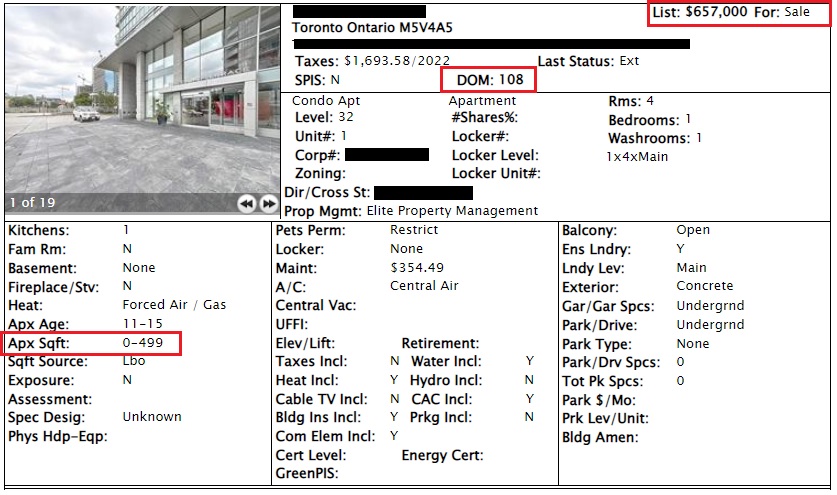

I saw this listing last week and my eyes just about jumped out of my head:

This unit is 480 square feet.

It’s listed for $1,369/sqft.

We’ve seen units listed much higher elsewhere in the city of Toronto, so it’s not like this is a figure we’re laying eyes on for the very first time.

But in this particular building?

Yikes.

Here are the last two sales

1) 1-Bed, Den, 1-Bath, 620 Sqft. No parking. $600,000 on August 17th. $968/sqft.

2) 1-Bed, Den, 1-Bath, 650 Sqft. Parking. $640,000 on August 24th. $985/sqft.

There’s just no comparison.

And sadly, this is representative of so much of the active inventory out there right now.

Last, but not least, I had a feeling this one wouldn’t end on a positive note.

A hosue was sold in January for $1,710,000 and re-listed in August, but this is not one of those case where the original buyer walked away.

The January sale closed in March and the new owners put the house up for sale five months later for $1,869,000.

But that didn’t work. And why would it? It was $160,000 more than they paid in January, and the average sale price in August, in this region, was down from January.

So they listed at $1,799,000.

Then they dropped the price to $1,699,000.

After that didn’t work, they did something drastic:

How’s $999,000 with an offer date?

Offers on this property were submitted last Monday night and they got twelve.

But the listing still hasn’t been updated.

That tells me the property didn’t sell, since under TRREB rules, you have 24 hours to update the listing after a sale.

But more importantly, and more annoyingly, the listing remains up at $999,000 with “Offers Reviewed November 21st.”

This is “fishing” at its finest. The agent is looking for calls on the $999,000 listing.

But wait – weren’t there twelve offers on the property? Aren’t those the best twelve leads the seller and listing agent could have?

Sure, but don’t tell them that. They’re still looking for that magic buyer who’s looking to pay 170% of the list price…

Well, maybe in the end there was only one positive story in the group here, but that wasn’t by design.

I just don’t understand the “strategies” in this market, or rather, the lack thereof.

And we’ve only got about three weeks left before things really die down…